Managing finances is a critical aspect of running a business, and effective budgeting plays a crucial role in ensuring its success. In today’s fast-paced and complex business environment, organizations need robust tools to streamline their budgeting processes. This is where ERP budgeting software comes into play, providing businesses with a comprehensive solution to efficiently plan and control their finances.

Budgeting is an essential aspect of financial management for any organization. Effective budgeting enables companies to plan and control their finances, allocate resources wisely, and make informed decisions. However, traditional budgeting methods can be time-consuming, error-prone, and lack the necessary flexibility to adapt to changing business needs. This is where ERP Budgeting Software comes into play, offering a solution that streamlines financial planning and control for modern enterprises.

What is ERP Budgeting Software?

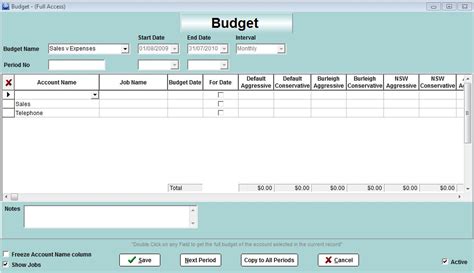

ERP budgeting software is a specialized application that integrates with an organization’s enterprise resource planning (ERP) system to facilitate the budgeting process. It allows businesses to create, manage, and track budgets in a centralized and automated manner, eliminating the need for manual spreadsheets.

Key Features of ERP Budgeting Software

1. Centralized Budgeting: ERP budgeting software provides a single platform to consolidate all budgeting activities, making it easier for finance teams to collaborate and manage budgets across departments and locations.

2. Automation: By automating repetitive tasks such as data entry, calculations, and reporting, ERP budgeting software saves valuable time and reduces the risk of errors. This enables finance teams to focus on strategic decision-making.

3. Real-time Visibility: With ERP budgeting software, businesses can access real-time financial data, enabling them to make informed decisions and quickly respond to market changes. This enhances agility and improves overall financial performance.

4. Forecasting and Scenario Planning: Advanced ERP budgeting software offers forecasting and scenario planning capabilities, allowing businesses to simulate different scenarios and assess their financial impact. This helps organizations make proactive decisions to mitigate risks and optimize resource allocation.

Benefits of ERP Budgeting Software

1. Enhanced Accuracy: By eliminating manual errors and ensuring data consistency, ERP budgeting software improves the accuracy of budgeting processes. This leads to more reliable financial forecasts and enables better decision-making.

2. Increased Efficiency: The automation capabilities of ERP budgeting software significantly reduce the time and effort required to create and manage budgets. This allows finance teams to allocate their resources more efficiently and focus on value-added activities.

3. Improved Collaboration: With a centralized platform for budgeting, ERP budgeting software promotes collaboration among different departments and stakeholders. This fosters transparency, alignment, and accountability, leading to better budget control.

4. Scalability and Flexibility: ERP budgeting software is highly scalable and can adapt to the changing needs of businesses. It can handle large volumes of data and accommodate complex budgeting requirements, making it suitable for organizations of all sizes and industries.

Why ERP Budgeting Software Matters

ERP Budgeting Software integrates financial planning and budgeting into an organization’s Enterprise Resource Planning (ERP) system. This integration offers several benefits, including:

- Improved Accuracy: ERP Budgeting Software uses real-time data from the ERP system, ensuring accurate and up-to-date budgeting information.

- Enhanced Collaboration: Multiple users can access and update the budget simultaneously, promoting collaboration and streamlining the budgeting process.

- Increased Flexibility: ERP Budgeting Software allows for easy adjustments to the budget, accommodating changes in business needs and market conditions.

- Better Visibility: ERP Budgeting Software provides a comprehensive overview of the organization’s financial operations, enabling better decision-making.

Features of ERP Budgeting Software

ERP Budgeting Software offers several features that make financial planning and control more straightforward and efficient. These features include:

- Multi-Year Budgeting: ERP Budgeting Software allows organizations to create and manage budgets for multiple years, providing a long-term perspective on financial planning.

- Scenario Analysis: Users can run different scenarios based on various assumptions, enabling them to compare and evaluate different financial outcomes.

- Role-Based Access: ERP Budgeting Software provides role-based access, limiting access to sensitive financial information and ensuring data security.

- Automated Workflow: ERP Budgeting Software automates the approval process, reducing manual intervention and accelerating the budgeting cycle.

- Integration with ERP System: ERP Budgeting Software integrates with the organization’s ERP system, providing real-time data and enabling seamless financial planning and control.

Benefits of ERP Budgeting Software

ERP Budgeting Software offers several benefits to modern enterprises, including:

- Improved Operational Efficiency: ERP Budgeting Software automates the budgeting process, reducing manual intervention and improving operational efficiency.

- More Accurate Budgets: ERP Budgeting Software uses real-time data from the ERP system, ensuring accurate and up-to-date budgeting information.

- Better Decision-Making: ERP Budgeting Software provides a comprehensive overview of the organization’s financial operations, enabling better decision-making.

- Increased Collaboration: ERP Budgeting Software enables multiple users to access and update the budget simultaneously, promoting collaboration and streamlining the budgeting process.

- Enhanced Flexibility: ERP Budgeting Software allows for easy adjustments to the budget, accommodating changes in business needs and market conditions.

Challenges of ERP Budgeting Software

While ERP Budgeting Software offers numerous benefits, it also presents some challenges, including:

- High Implementation Costs: ERP Budgeting Software can be expensive to implement, requiring significant upfront investment.

- Complex Integration: Integrating ERP Budgeting Software with the organization’s existing ERP system can be complex and time-consuming.

- Data Quality Issues: Poor data quality can affect the accuracy of the budget, leading to incorrect decision-making.

- Training Requirements: ERP Budgeting Software requires proper training to use effectively, adding to the overall cost and time required for implementation.

Implementing ERP Budgeting Software

Implementing ERP Budgeting Software requires careful planning and execution. Here are some steps to consider:

- Define Goals and Objectives: Clearly define the goals and objectives of the implementation, ensuring that they align with the organization’s overall financial management strategy.

- Choose the Right Software: Research and evaluate different ERP Budgeting Software options, choosing the one that best fits the organization’s needs and budget.

- Prepare Data: Cleanse and prepare the data from the existing ERP system, ensuring that it is accurate and up-to-date.

- Test and Validate: Test and validate the ERP Budgeting Software, ensuring that it works correctly and integrates with the existing ERP system.

- Train Users: Provide proper training to users, ensuring that they understand how to use the software effectively.

- Monitor and Review: Monitor and review the ERP Budgeting Software regularly, ensuring that it continues to meet the organization’s needs and identifying any areas for improvement.

FAQs

1. Can ERP budgeting software integrate with my existing ERP system?

Yes, most ERP budgeting software solutions are designed to seamlessly integrate with popular ERP systems, ensuring smooth data flow and synchronization between the two applications.

2. Is ERP budgeting software only suitable for large enterprises?

No, ERP budgeting software can benefit businesses of all sizes. Small and medium-sized enterprises can also leverage its features to streamline their budgeting processes and improve financial planning.

3. Can ERP budgeting software handle multiple currencies?

Yes, ERP budgeting software can handle multiple currencies, making it ideal for businesses operating in international markets or dealing with foreign currencies.

4. How secure is the data stored in ERP budgeting software?

ERP budgeting software providers prioritize data security and implement stringent measures to protect sensitive financial information. This includes encryption, access controls, and regular backups to ensure data integrity and confidentiality.

5. Can ERP budgeting software generate customizable reports?

Yes, ERP budgeting software allows users to generate customizable reports, providing them with the flexibility to analyze budgeting data according to their specific requirements.

Conclusion

ERP Budgeting Software is a powerful tool that can streamline financial planning and control for modern enterprises. By integrating financial planning and budgeting into an organization’s ERP system, ERP Budgeting Software offers improved accuracy, enhanced collaboration, increased flexibility, and better visibility. While there are challenges associated with implementing ERP Budgeting Software, careful planning and execution can help organizations reap the benefits of this powerful tool. With proper implementation, ERP Budgeting Software can help organizations improve operational efficiency, make better decisions, and achieve their financial goals.